Battery management ICs are essential components used in electronic systems to manage rechargeable batteries. These integrated circuits play a crucial role in safeguarding the battery from operating outside its Safe Operating Area (SOA) and monitoring its state, health, and data reporting. Various types of battery management ICs include battery charger ICs, fuel gauge ICs, and authentication ICs. Among them, the fuel gauge IC, also known as the gas gauge IC, is specifically responsible for determining the battery’s health and state of charge (SOC).

Battery Management ICs Market Outlook (2024-2032)

The projected market outlook for global battery management ICs between 2024 and 2032 indicates that as of the end of 2023, the global market was valued at about US$8.0 billion. The market is projected to reach US$ 9.91 billion by 2032, exhibiting a CAGR of 3.1% between 2024 and 2032. While battery management system ICs currently account for approximately 1% of global integrated circuits sales, the increasing need for managing rechargeable batteries has resulted in significant adoption across various industries.

Market Dynamics

Technological Advancements and Sustainability Trends

Rapid technological advancements, coupled with rising urbanization and improving consumer spending, have led to a surge in demand for consumer electronic devices, subsequently driving the demand for batteries, cells, and packaging solutions. The growing adoption of electric vehicles to reduce the carbon footprint has also increased the demand for lithium-ion batteries.

The trend towards sustainability and green energy sources has further amplified the demand for batteries in sustainable energy sectors. Furthermore, the increasing consciousness of zero-emission vehicles has contributed to a greater demand for batteries within the automotive industry. For example, in 2018, global EV sales reached around 2.1 million, a 64% increase from 2017, led by China as the largest EV manufacturer. Technological advancements and market trends are driving the expected growth in the battery management ICs market during the forecast period.

Challenging Economic and Political Scenarios

Battery management integrated circuits feature sophisticated technology and require a complex integration process, necessitating skilled technicians for manufacturing. The consumer electronics market has been adversely impacted by the ongoing trade war between the U.S. and China, as well as the effects of Brexit, resulting in slower growth rates in the IC market. Additionally, economic crises and recession in Germany have caused disruptions in various sectors, including construction and infrastructure development, which have also had ripple effects on other economies like Spain and Greece.

High tariffs on products have disrupted global trade and the economy. The trade war between the U.S. and China has significantly impacted the electronics sector, as China is a major producer and consumer of electronic devices. These economic and political uncertainties are challenging for the lipo battery management IC market and lead acid battery management IC market.

Widening Application Areas

The constant evolution of battery technology has driven manufacturers to develop battery management systems for a wide range of applications. In the present day, electronic devices have become increasingly mobile and eco-friendly, and battery advancements play a significant role in enhancing various products, ranging from portable power tools to plug-in hybrid electric vehicles and wireless speakers.

Growing environmental concerns and the Paris Agreement’s commitments have encouraged governments and organizations to invest in green technologies, which has further bolstered the market for Power Management Integrated Circuits.

Segmental Analysis

Battery Charger IC

The battery charger IC segment accounted for the highest market share in terms of value, with USD 4,238.7 million, and is expected to reach USD 6,200.4 million by 2029. Battery charger ICs are extensively utilized in diverse handheld equipment and electric vehicles, providing precise charge current and voltage tailored to specific battery cells in various appliances. Companies like Analog Devices and NXP Semiconductors actively provide a diverse selection of high-performance battery charger IC devices for various battery chemistries, such as Li-ion, lead-acid, and nickel-based batteries.

Automotive Industry

The automotive industry wields significant influence over the lithium battery management IC, battery charger IC, and battery protection IC market, especially in the realm of electric vehicles. As the demand for vehicles and electric cars surges, the need for BMS ICs grows in tandem. China and Japan play crucial roles in the automotive market, with China accounting for 45% of the global electric vehicles on the road and Japan renowned for its technological prowess in producing electrical and automotive components.

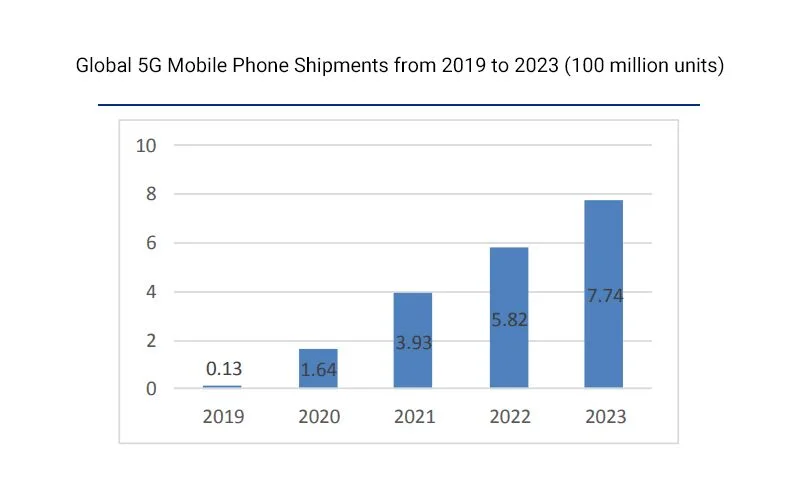

5G mobile phones

5G mobile phones put higher requirements on BMS chips. With the comprehensive popularization of 5G mobile phones, the acceleration of multi-penetration rate, 120Hz high screen brush, more 5G RF components, and high-performance CPU iteration, constantly improve the high power consumption of mobile phones. According to Canalys, global 5G phone shipments will reach 774 million units in 2023, accounting for 51.4% of the entire smartphone market share; Among them, China, as the key region of global 5G network construction, will be the world’s largest 5G smartphone market, with shipments expected to account for 34% of the global market. In general, the energy consumption of 5G mobile phones in the network is 20%-30% higher than that of 4G. The 4000mAh previously known as “large capacity” is not an insurable red line, and 4500mAh is the mainstream of the current 5G mobile phone battery capacity.

Smartwatches

Mainstream smart watches mainly adopt the multi-chip solution of “Bluetooth SoC+MCU+ multiple IC (battery management, radio frequency, etc.)”, and the high battery life puts forward high requirements for battery management ICs. Smartwatch has a set of the independent embedded operating system, there is a data processing center, which needs to call the information collected by various sensors, but also have a screen, memory, battery management system, radio frequency system, etc., in the internal chip materials and structure design is more similar to a smartphone, among which the master control chip is the core device of smartwatch, according to I love audio network, the main control chip accounts for about 30% of the cost of a smartwatch.

Smartwatches have problems with battery life, which largely depends on the power of the battery. From the perspective of the popularity of smartwatch functions, the health monitoring, call, exercise management, GPS positioning, and other functions of smartwatches are expected to be retained and can be continuously upgraded and iterated in terms of technology. From the perspective of the application of smartwatches, the trend of smartwatches as independent mobile terminals is constantly strengthening, which puts forward higher requirements for the system’s ease of use, rich APP functions and applications, battery life, and power consumption of smartwatches, and then puts forward higher requirements for battery management ICs.

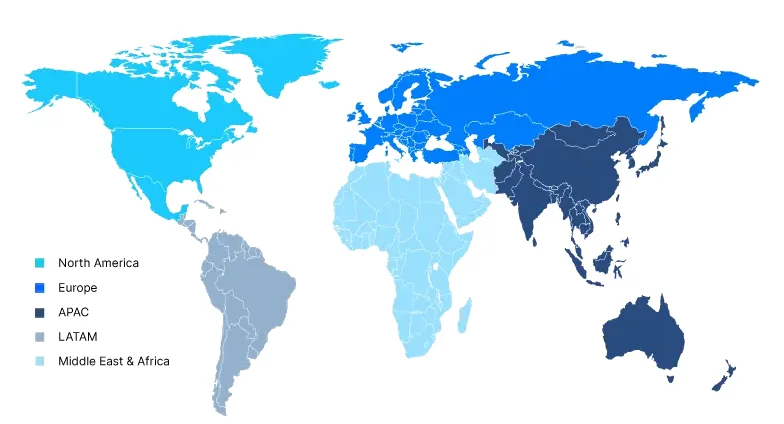

Regional Analysis

North America: The Largest Share Holding Region

North America commands the largest share of the battery management IC market, primarily propelled by the growth in data centers and cloud computing. The region boasts some of the world’s largest data centers, which necessitate battery management ICs to ensure efficient power management and storage. With the increasing demand for data centers, there will be a corresponding rise in the need for battery management ICs.

APAC (Asia-Pacific) to Grow at a Fast Pace

The Asia-Pacific region is experiencing rapid growth in the battery management IC market, predominantly driven by the flourishing automotive industry, particularly in China and Japan. China’s automotive market stands as one of the largest globally, boasting a vast number of electric vehicles on the road. Japan’s technological prowess in producing electrical and automotive components further augments the demand for battery management ICs in the region.

Top 13 Key Players in the Battery Management IC Market

- Analog Devices, Inc.

- Semiconductor Components Industries, LLC

- Maxim Integrated

- Microchip Technology Inc

- NXP Semiconductors

- ROHM Co., Ltd.

- Semtech Corporation

- Richtek Technology Corporation

- Renesas Electronics Corporation

- Texas Instruments Incorporated

- Skyworks Solutions, Inc.

- STMicroelectronics

- Diodes Incorporated

Several key players, such as Analog Devices, Inc., Semiconductor Components Industries, LLC, Maxim Integrated, Microchip Technology Inc, NXP Semiconductors, and others dominate the battery management IC market. These companies offer advanced battery management ICs that improve battery monitoring and balancing, enhance safety, and enable reliability in electric vehicles and other applications.

Mokoenergy’s BMS

Among the key players, MOKOEnergy stands out with its advanced Battery Management System (BMS) products. Mokoenergy’s BMS solutions are designed to efficiently manage rechargeable batteries and ensure their safe operation in various electronic systems. The company’s technological expertise and focus on sustainable energy management solutions and energy storage solutions significantly contribute to the growth of the battery management IC market.

Factors to Consider in IC Selection

When selecting the appropriate IC for specific applications, several factors must be considered:

Battery Cell Chemistry: Different battery cell chemistries (e.g., lithium-ion or lithium iron phosphate) have varying nominal voltage levels, which dictate the suitability of the IC for a particular battery type.

Number of Cells in Series: The IC should be capable of handling the total number of cells in the battery management system, accommodating different cell configurations.

Protection: Comprehensive protection features are essential for battery systems, including overvoltage, undervoltage, overcurrent, short circuit, overtemperature, and under-temperature protection.

Cell Balancing: Cell balancing may be required, and the IC should support either passive or active cell balancing based on the system’s needs.

Monitoring: The IC should provide necessary monitoring features for voltage, temperature, and current to ensure optimal battery performance.

State of Charge (SoC) Estimation: The IC may offer direct SoC measurement or require external gauging methods for estimating the state of charge accurately.

Drive Control: Depending on the application, the IC should offer suitable means of battery control, whether mechanical (e.g., contactor) or internal through field-effect transistors like MOSFETs.

Fault Detection: The sophistication level required for fault detection, including alerts or automatic shutdown mechanisms, should be evaluated.

Interfacing Protocol: The IC should support the necessary interfacing protocol (e.g., UART, I2C, SPI) for communication with other external ICs if needed.

Automotive or Industrial Grade: The application’s safety and cost considerations determine whether automotive-grade or industrial-grade ICs are preferred.

Conclusion

Technological advancements, sustainability trends, expanding application areas, and automotive industry demand are propelling the battery management IC market toward significant growth. As the world shifts toward greener technologies and sustainable energy solutions, the BMS IC market will witness continued expansion in the foreseeable future. Key players like Mokoenergy and other industry leaders are well-positioned to capitalize on the growing demand for battery management ICs and play a pivotal role in shaping the future of energy storage and energy management. Reach us if wanna discuss more industry trends or sourcing anything we provide.